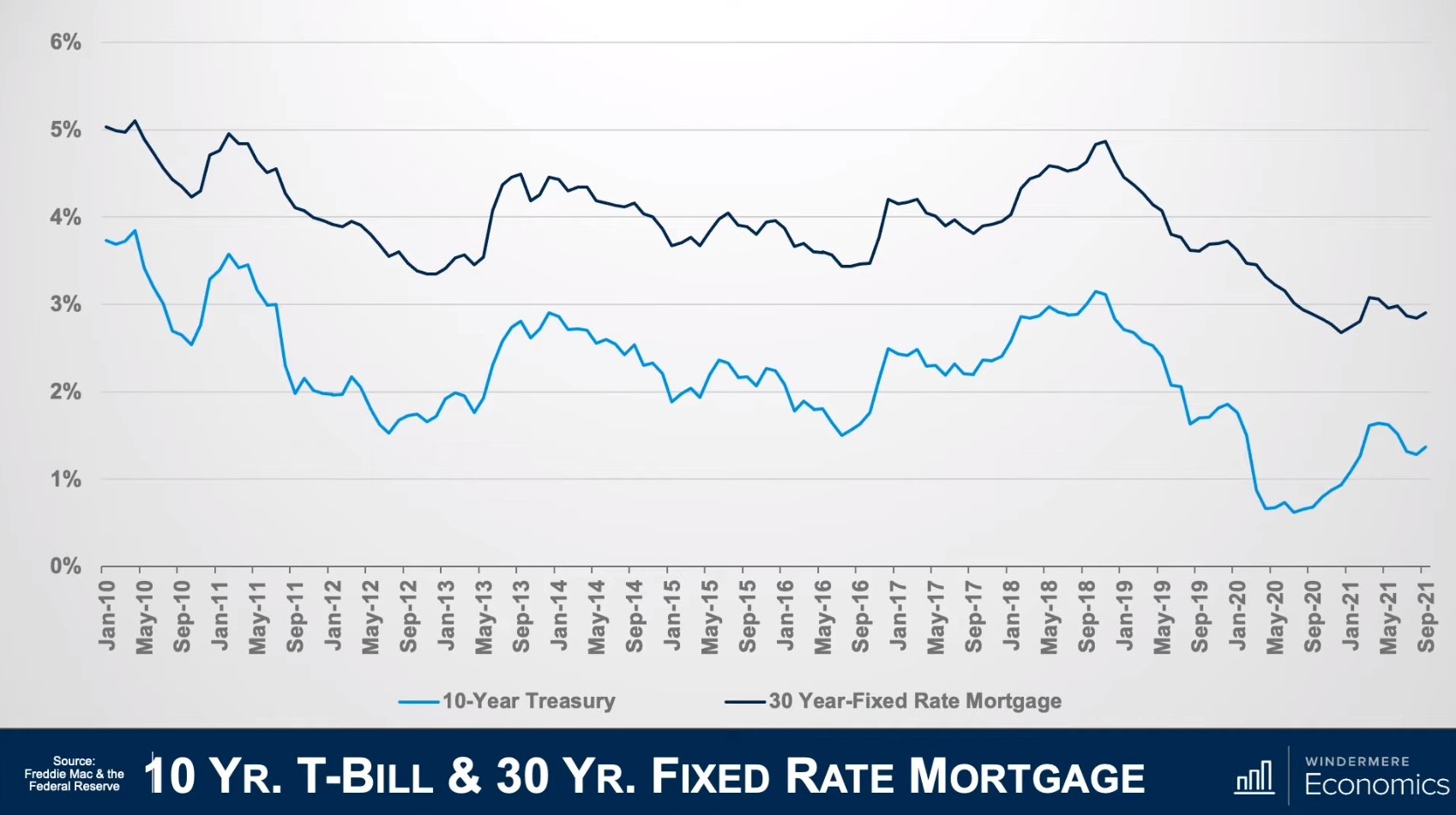

This months Monday's with Matthew focuses on mortgage rates and what we can expect for the future. Gardner gives a crash course on how mortgage rates are set. There are many factors that impact the rate a homebuyer will get, which include credit scores and loan to value ratios, but the base rate is set by looking at the economy itself - specifically the bond market.

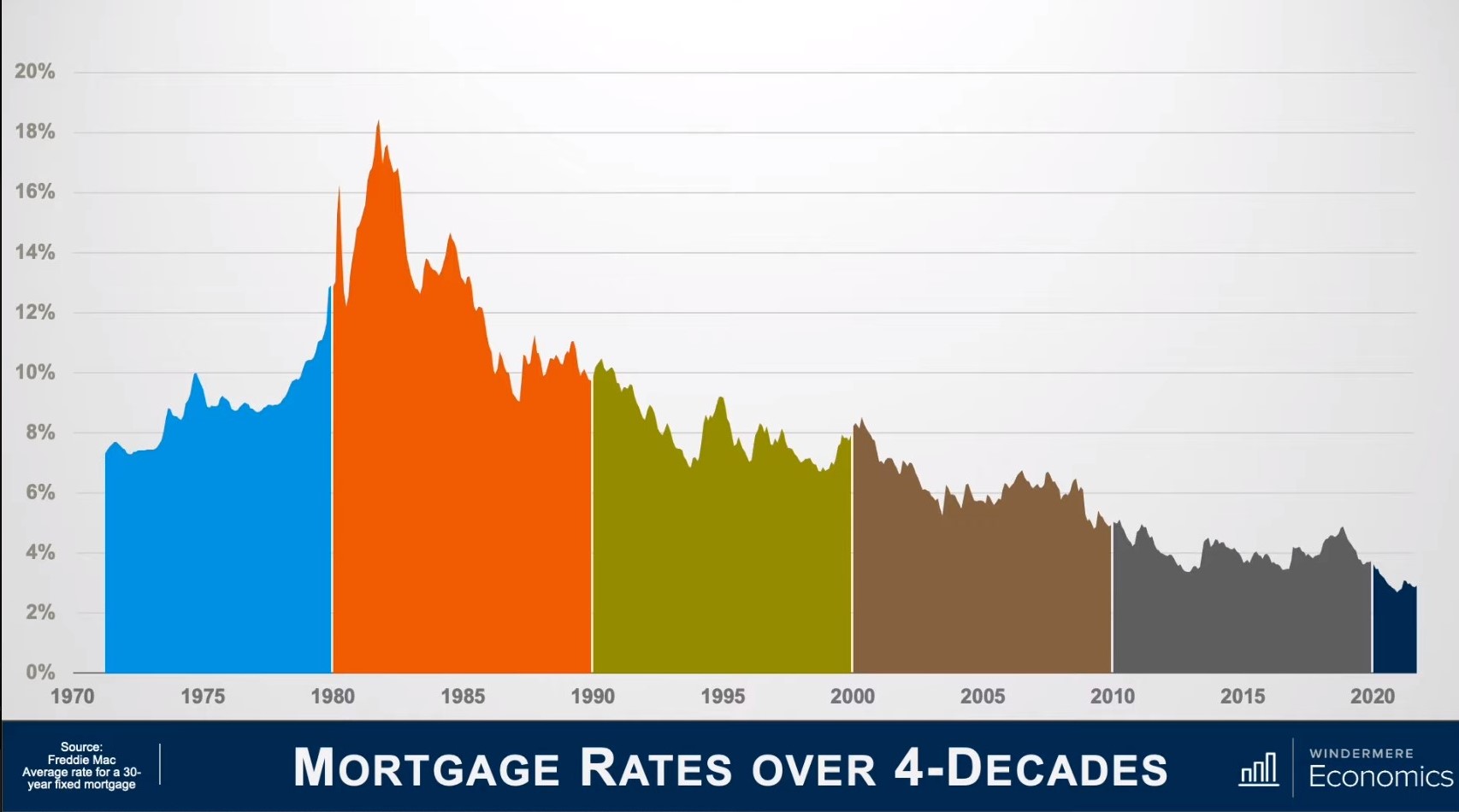

Moving on, the chart below shows mortgage rates over the past four decades. On Thursday, March 19th, 2020, the Fed went on a massive bond buying spree. The very next day they announced they were going to buy even more, and because of this rates dropped dramatically and continued to drop the rest of the year.

Rates began to rise at the end of the year due to the election, improvement from COVID-19, and more vaccination distribution.

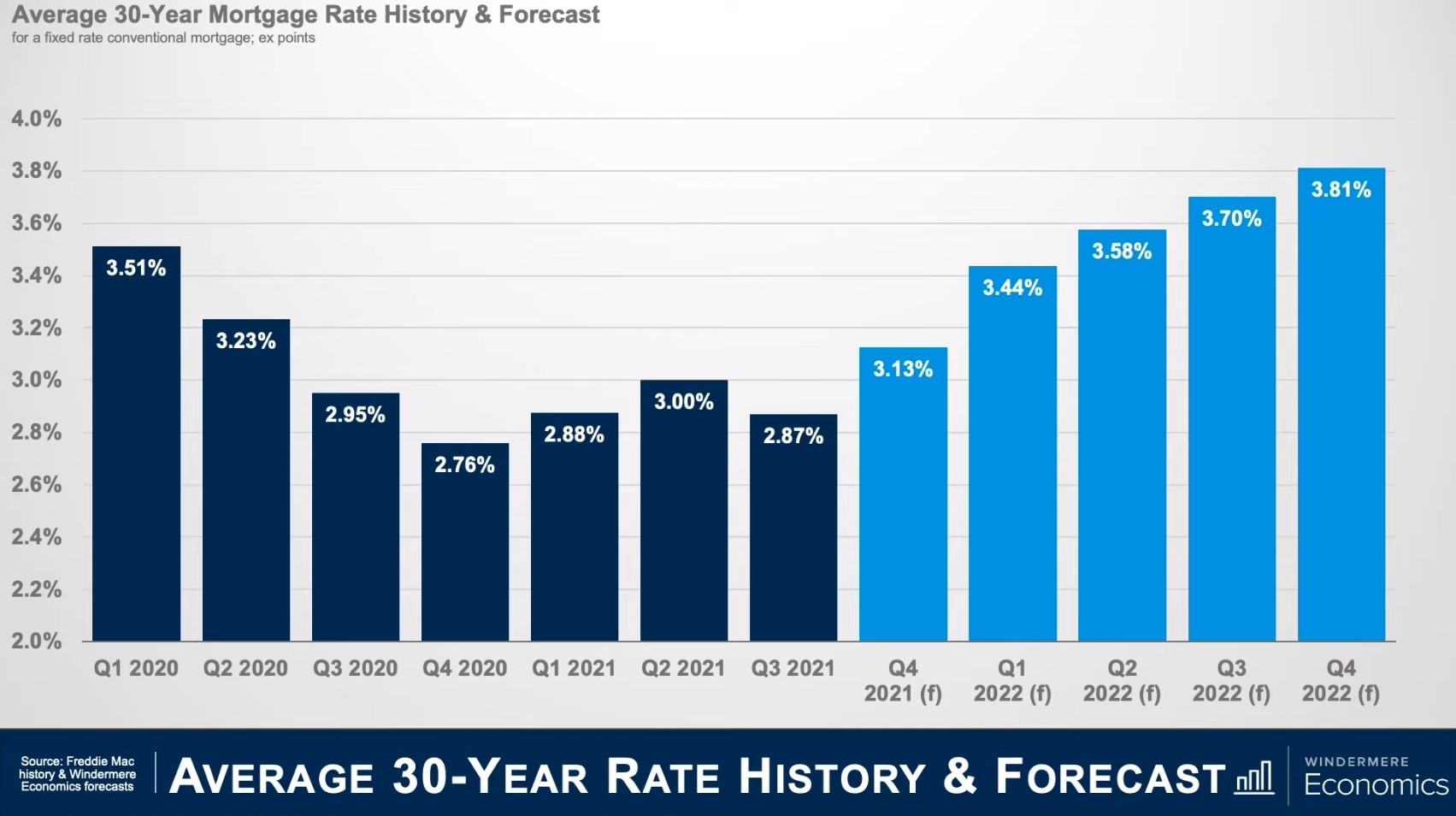

Gardner's forecast for mortgage rates is that they will move higher throughout next year, but will not break above 4% until 2023. Even as they start to increase, Gardner does not believe it will be a major deterrent to home buyers.

The bottom line is that although mortgage rates will rise they will still remain very competitive when compared to historic averages and the upward trend is unlikely to have any significant impact on prices. Many markets are having an affordability crisis and this may affect price growth, but it will take a greater increase in rates to affect prices.