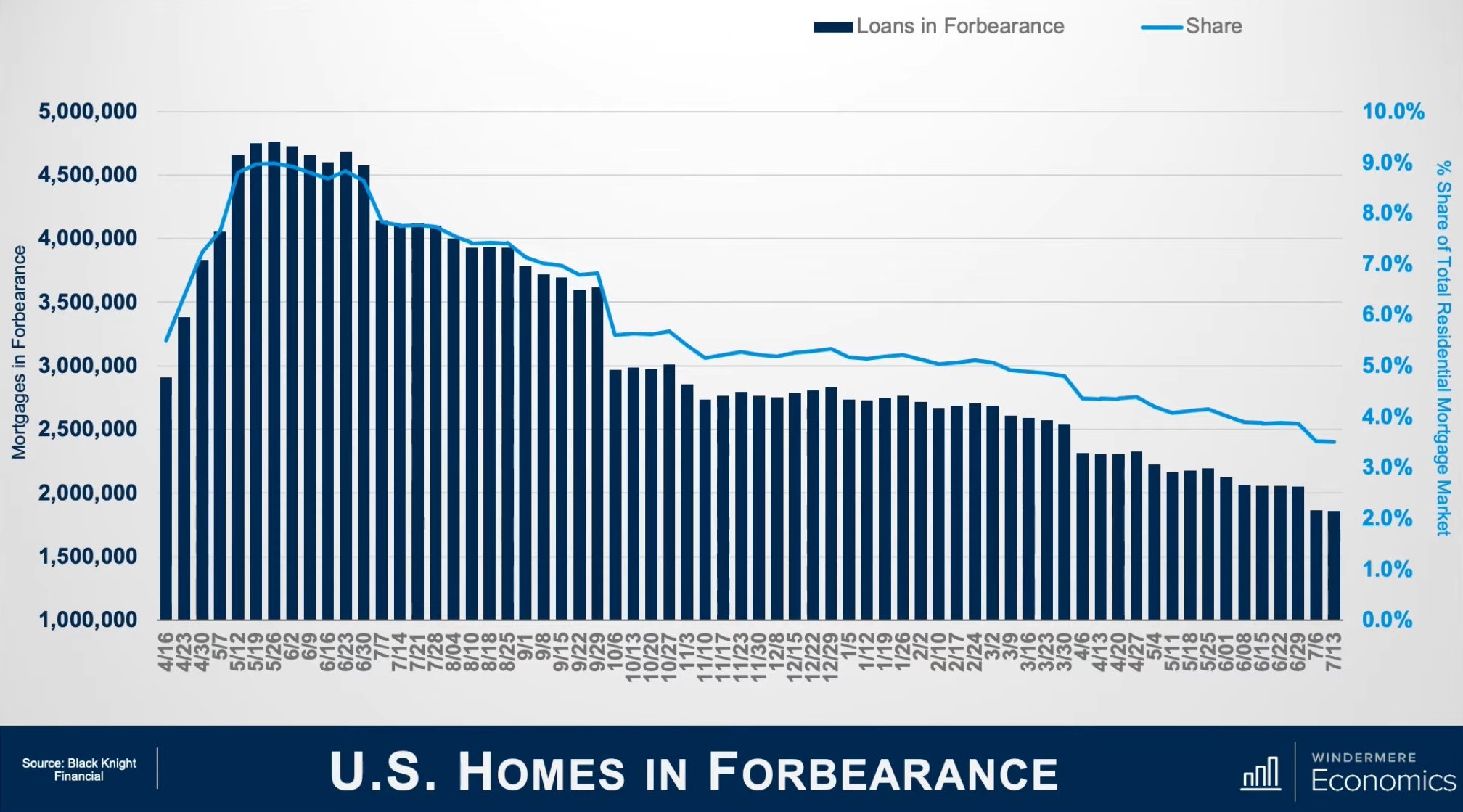

This was a great month to look at the data for the number of homes in forbearance as the program stopped taking new applications at the end of June. The situation today is a vast improvement from where we were last may. More than 4.76 homes were in the program last May, but by mid-July this year the number dropped to just 1.86 million homes. This is an impressive recovery, as 2.9 million homeowners left the program between May 2020 and mid-July of 2021.

The number of active forbearance plans continue to fall, but the pace of the drop has certainly slowed over the last quarter or so.

Looking forward, almost 600,000 homes currently in forbearance are up for review, so the potential for a greater rate of improvement of the number of homes in the program is possible but not guaranteed.

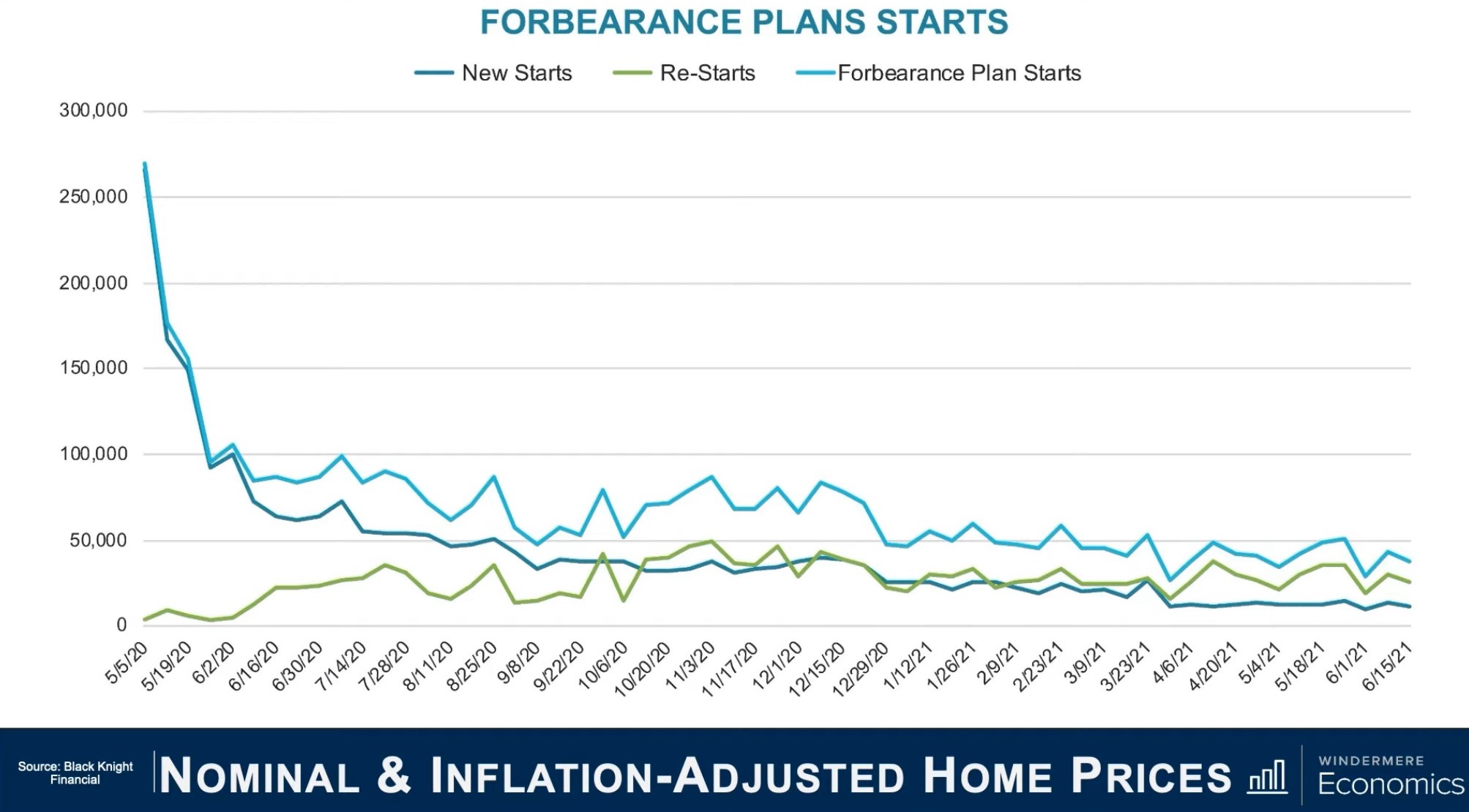

Starts are down by 3%, and new and repeat starts are 3-4% lower month over month. Of the roughly 460,000 homes in forbearance that were reviewed for extension or removal we saw 33% leave the program and 67% extend it. This is a low removal rate and we only expect people to come out of the program if the country continues to open up.

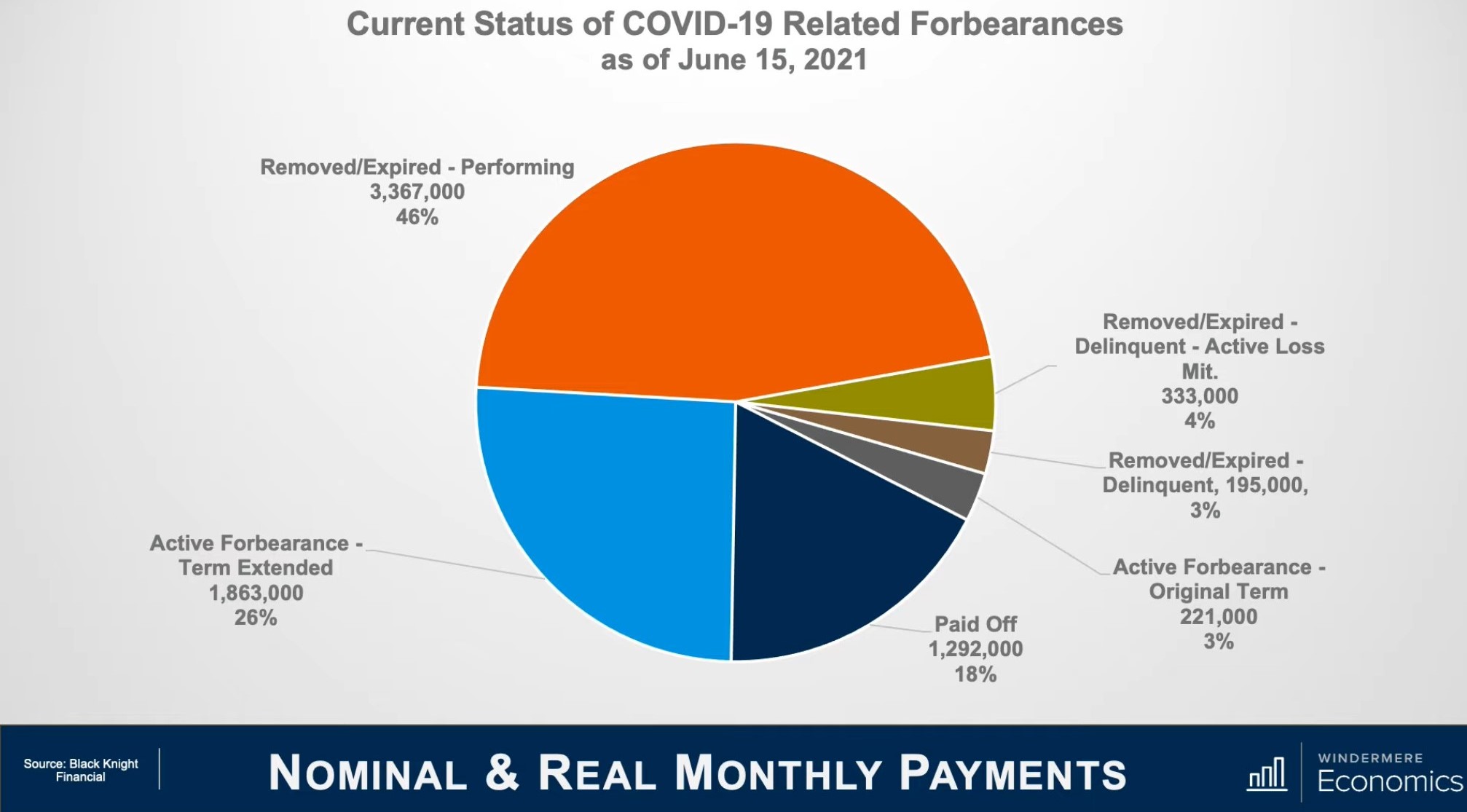

Roughly 7.25 million borrowers have used forbearance at one time or another throughout the course of the pandemic which represents 14% of homeowners in the country. Of that 7.25 million, 72% have left the plan and 28% remain in active forbearance. Loan performance remains pretty robust among homeowners who have left the program with 46% of borrowers getting things wrapped up with their lender on missed payments and 18% of homeowners paying off their loan in full.

Although the number of homes leaving the program has slowed, we still expect further improvement as we move through the year because we won’t be seeing any new homeowners entering the program.

There are a couple of conclusions that can be drawn from this data. The first is that anyone believing there will be a flood of homes foreclosed on by the end of this year or 2022 is likely to will be disappointed. Even if every home in the program entered foreclosure the number of homes that would be foreclosed on would be minimal compared to the fall out following the financial crisis of more than a decade ago. Also, the build up of equity that all homeowners have seen if they bought before 2012 or even more recently suggest that if for whatever circumstance that homeowners in forbearance can’t get their head above water they will sell their home in order to keep the equity that they have accumulated. The bottom line is that the forbearance program was needed, and it has been successful so far at warding off home foreclosures due to the impact of the pandemic, but we will not see a huge wave of foreclosures in our near future.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link