Quick Update from Matthew Gardner: How Will Election Results Impact the Housing Market?

Michael Hyman is the National Association of Realtor’s Research Data Specialist. Below is his most recent article from November 13, 2020, discussing the housing affordability index, median family income, and mortgage rates.

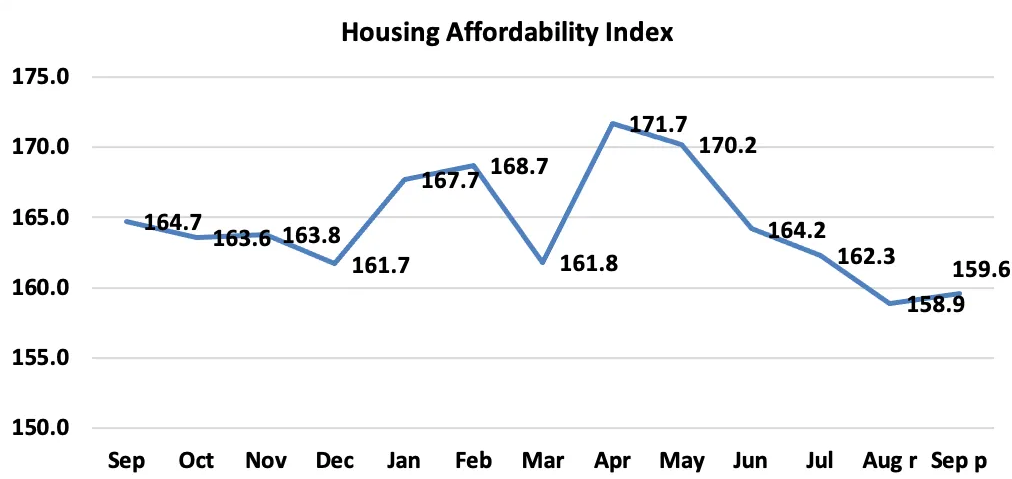

“At the national level, housing affordability declined in September 2020 compared to a year ago but rose compared to August, according to NAR’s Housing Affordability Index. Affordability increased in September compared to August as the median family income rose by 2.3% while the median home prices rose by 15.2%. The effective 30-year fixed mortgage rate fell to 2.95% this September from 3.00% in August. Mortgage rates are at all time lows compared to a year ago at 3.65%.

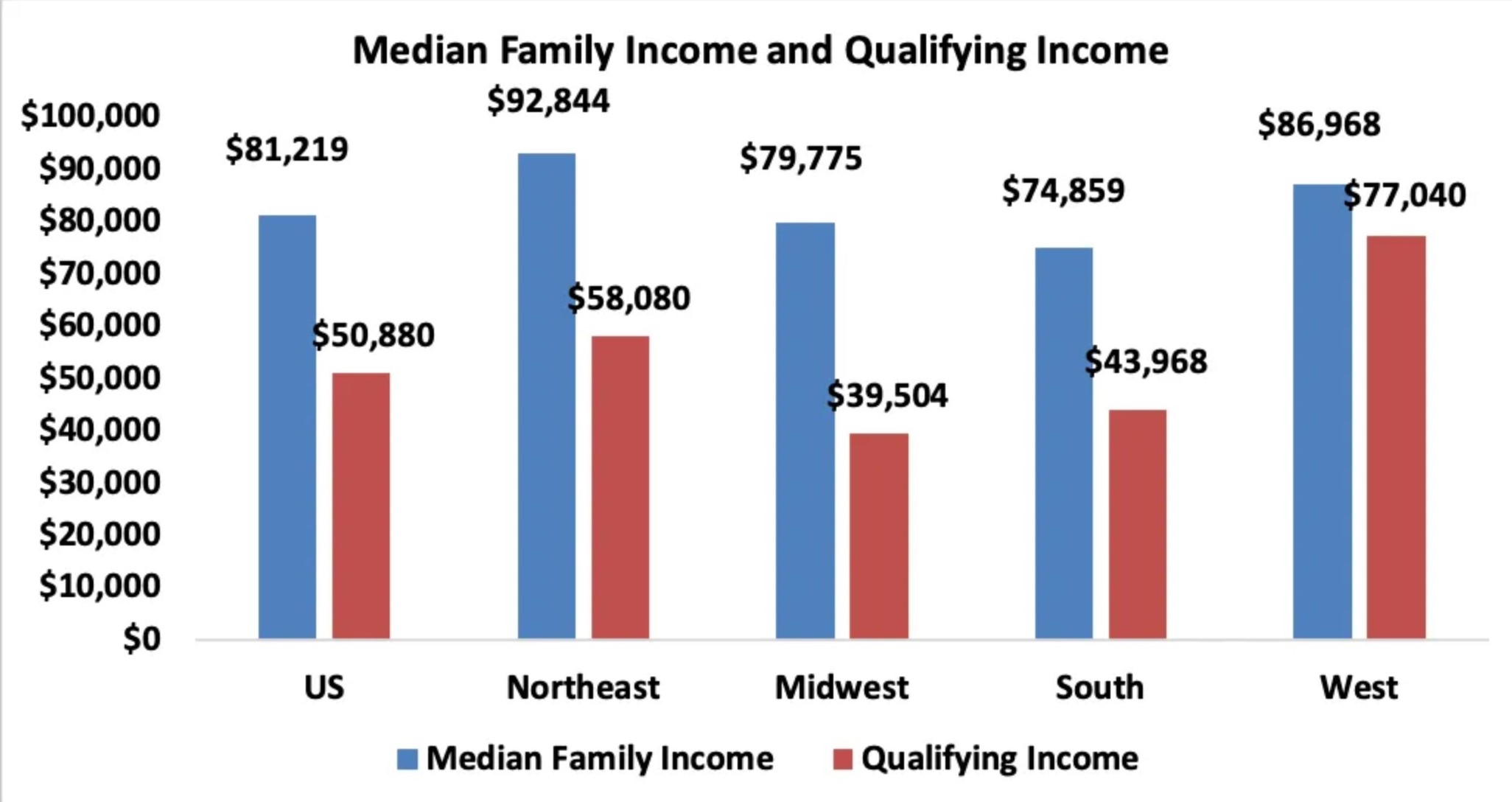

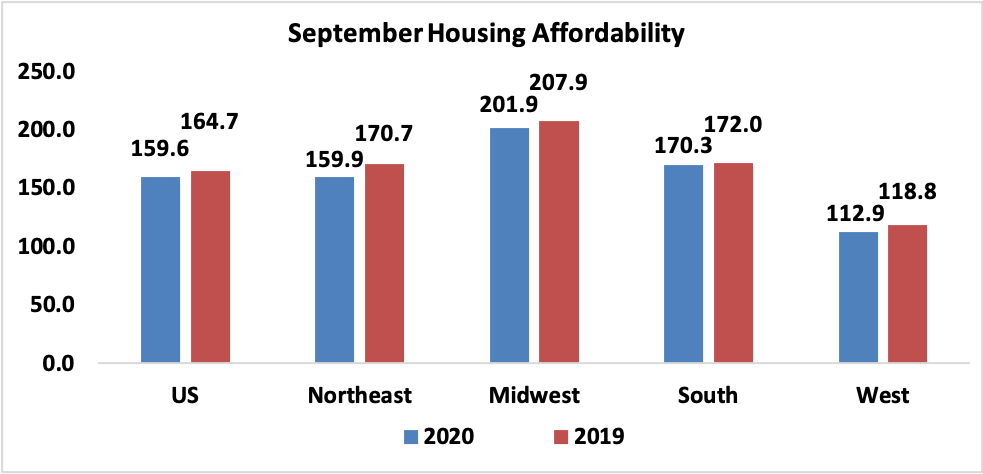

As of September 2020, the national and regional indices were all above 100, meaning that a family with the median income had more than the income required to afford a median-priced home. The income required to afford a mortgage, or the qualifying income, is the income needed so that mortgage payments make up no more than 25% of family income. The most affordable region was the Midwest, with an index value of 201.9 (median family income of $79,775 which is twice the qualifying income of $39,504). The least affordable region remained the West, where the index was 112.9 (median family income of $86,968 and the qualifying income of $77,040). For comparison, the index was 170.3 in the South (median family income of $74,859 and the qualifying income of $43,968) and 159.9 in the Northeast (median family income of $92,844 with a qualifying income of $58,080).

Housing affordability declined from a year ago in all regions. The South had a decline of 1.0% followed by the Midwest with a dip of 2.9%. The West had a drop of 1.0% followed by the Northeast with the biggest decrease in affordability at 6.3%.

Affordability is down in two of the four regions from last month. The South had a gain of 1.8% followed by the Midwest with an incline of 2.3%. The Northeast had a decline of 1.1% followed by the West with a dip of 2.3%.

Nationally, mortgage rates were down 70 basis points from one year ago (one percentage point equals 100 basis points). The median sales price for a single-family home sold in September in the US was $316,200 up 15.2% from a year ago, while median family incomes rose 2.3 % in 2020 from one year ago.

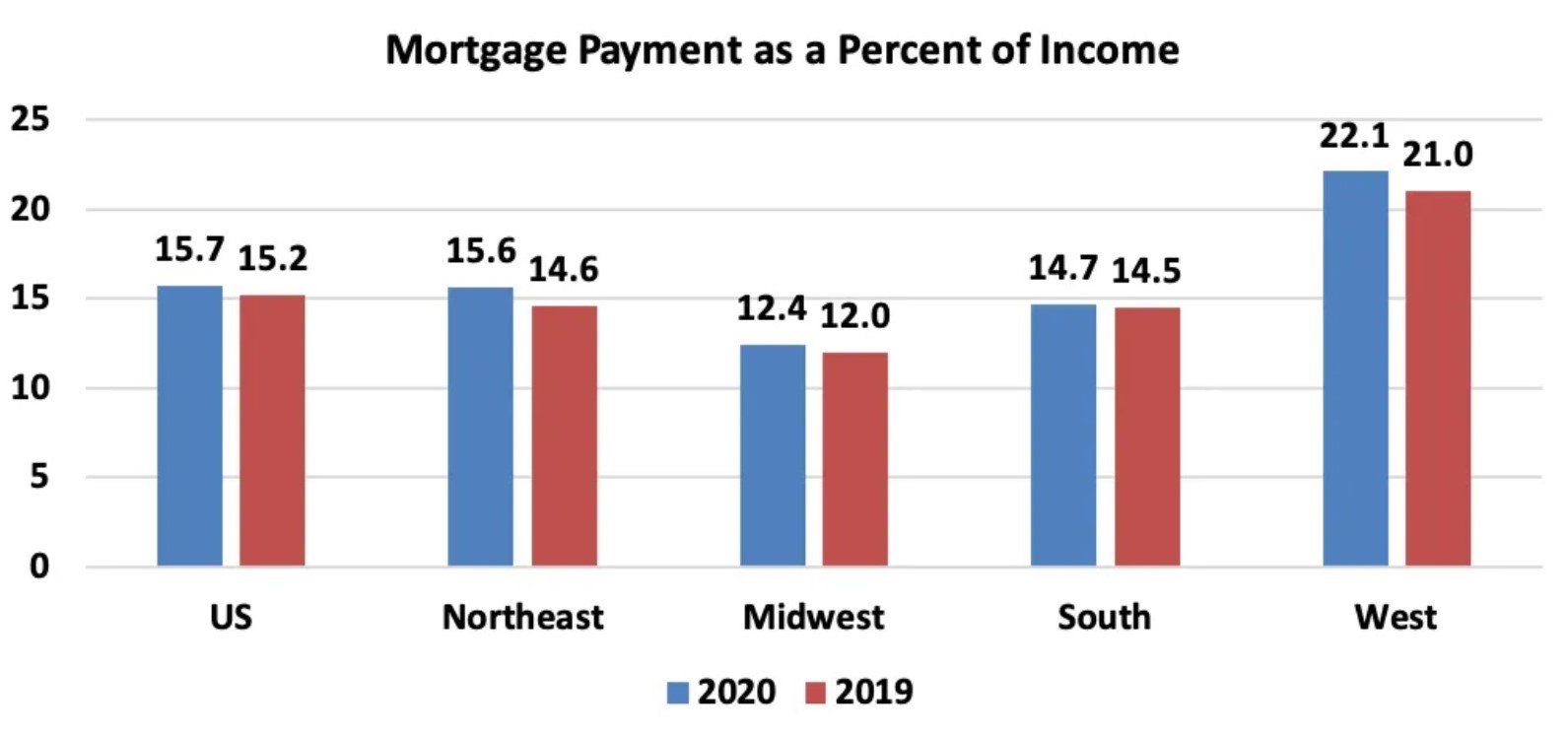

Even with lower mortgage rates compared to one year ago, the payment as a percentage of income rose to 15.7% this September from 15.2% from a year ago. Regionally, the West has the highest mortgage payment to income share at 22.1 % of income. The Northeast had the second highest share at 15.6% followed by the South with their share at 14.7%. The Midwest had the lowest mortgage payment as a percentage of income at 12.4%. Mortgage payments are not burdensome if they are no more than 25% of income.

This week the Mortgage Bankers Association reported mortgage applications decreased 0.5 from one week prior. Mortgage rates have continued to decline and are at a historic low. Demand for housing is still high with a lot of sellers sifting through multiple offers on their home. Low inventory levels remain an issue for first-time buyers and potential home owners.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link