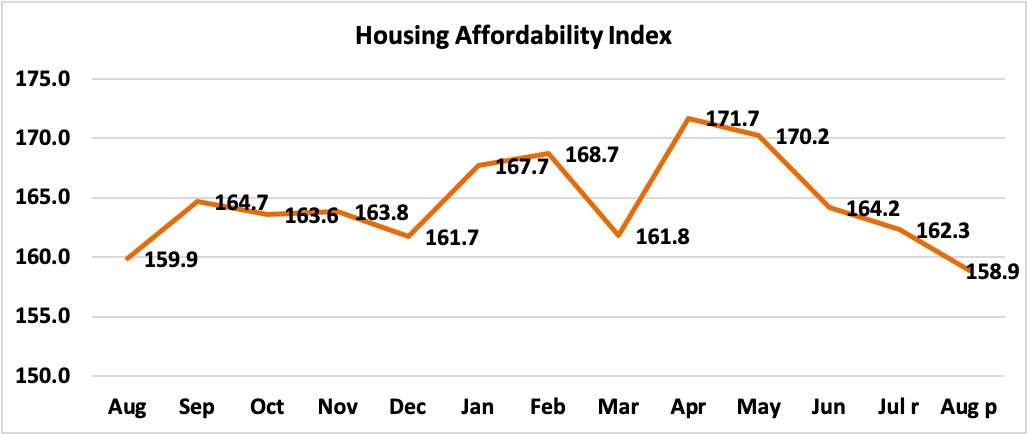

What this means in layman’s terms, is the low interest rates have fueled the housing market. This is causing home values to go up faster than interest rates are dropping. As a result we could find many buyers getting priced out of the market. When buyers exit a sellers market, supply and demand is affected. Sometimes this is where you will see a shift in the market. The higher the number in the housing affordability index indicates more affordability. The index is now on the decline. When it reaches 100 is when the median income qualifies for the median priced home.

Looking back to 2006 the affordability rate was 108. This represents the most expensive time to buy a home since 1990. In 2008, the market had shifted significantly downwards and the index increased to 138. This indicated the most affordable time to buy a house ever.

Shifting into April 2020, the index was at 171.7 reaching a new high in affordability. In October 2020, the National Association of Realtors published the chart below where we see a decline in the index down to 158.9 in August.

If the index continues to drop we will likely see a shift in the market from a sellers market to a buyer’s market, if the index approaches 100.

Remember when it goes below 100 the average family cannot afford the average home.

If you would like to discuss how this might affect you please feel free to contact me at (253) 732 – 2500.

Click here to view our real time market statistics in Gig Harbor!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link